Fasb gaap depreciation calculator

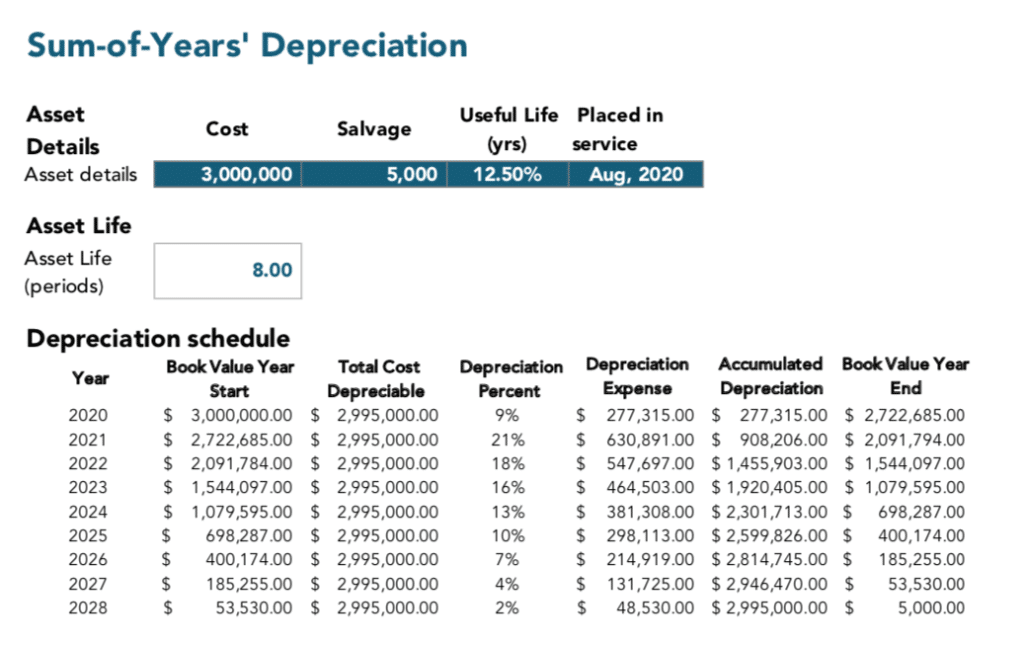

How is FASB GAAP depreciation calculated. The depreciation rate is then calculated by dividing the number of years left in the lifetime by this sum.

What Are Deferred Tax Assets And Deferred Tax Liabilities Article

FASB Response to COVID-19.

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

. Amortization or depreciation as it is sometimes still called is the decrease in resell value of assets incurred as a side effect of their use in business operations. Posted in News Tagged Bassets Depre123 Depreciation. At depre123 try out our Free Depreciation Calculator and check out our cloud based fixed assets application.

Rated The 1 Accounting Solution. Standards Board FASB US GAAP. Calculate hundreds thousands of records at the same time.

Year 5 works a little differently. Amortize premiums and discounts at any time. Ad QuickBooks Financial Software For Businesses.

Browsing by Topic Searching and Go To navigation. 2 File Calculation services. FASB GAAP software for Loans and Bonds.

To find the GAAP depreciation amount. Various Printing options including printer-friendly utility for viewing source references. Rated The 1 Accounting Solution.

For example the first year of an asset with three years of life would be. Professional ViewWhat You Get. 2021 GAAP Financial Reporting Taxonomy.

Consistent with current Generally Accepted Accounting Principles GAAP the recognition measurement and presentation of expenses and cash flows arising from a lease by a lessee. The 2022 GAAP Financial Reporting Taxonomy GRT contains updates for accounting standards and other improvements since the 2021 Taxonomy as used by issuers filing with the US. Cross Reference report and archive to locate and access legacy standards.

Send a bond file. The 2021 GAAP Financial Reporting Taxonomy GRT contains updates for accounting standards and other improvements since the 2020 Taxonomy. Accounting for the Tax Cuts and Jobs Act.

Get QuickBooks - Top-Rated Online Accounting Software For Businesses. Loans - FASB 91 fee income. Imagine you purchase an aircraft for 45 million and assume a 5 million salvage value in 10 years.

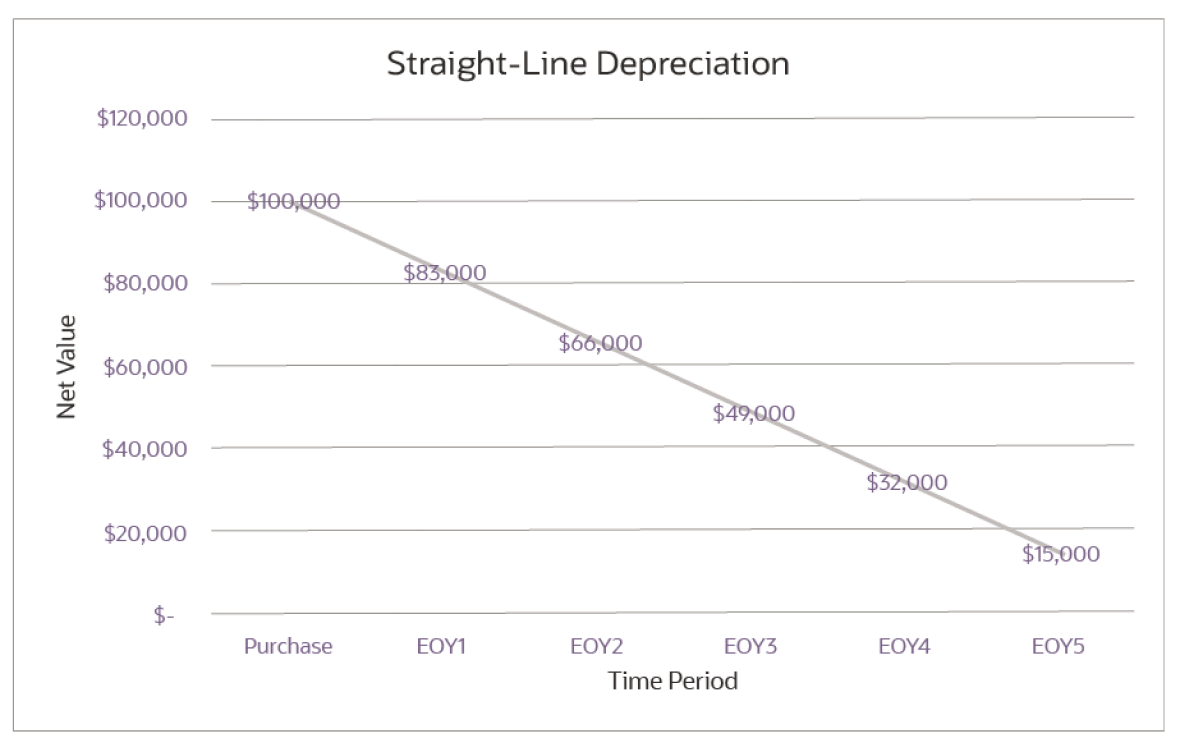

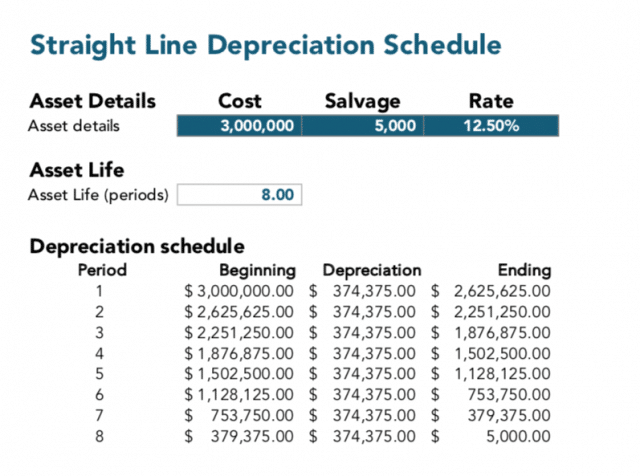

Distinguishing Liabilities from Equity. Straight-Line Depreciation Formula First year depreciation M 12 Cost Salvage Life. How is FASB GAAP depreciation calculated.

Under GAAP its important that depreciation is charged in full so the total amount of depreciation for the computers needs to add up to. Ad QuickBooks Financial Software For Businesses. First year depreciation M 12 Cost - Salvage Life Last year.

GAAP Depreciation Amount. Both the IASB and FASB aim to develop a set of high quality global accounting standards that require transparent and comparable information in general. Depreciation is an allocation of the cost of tangible property over its estimated useful life in a systematic and rational manner.

Duke calculates and reports depreciation in. These reports including the. Show All in One.

Pending Content System for filtering pending content display based on user profile. FASB Chair Richard R. 1 Order the software.

Run the software on your PC or network sharing device. Depreciation in Any Period Cost - Salvage Life Partial year depreciation when the first year has M months is taken as. Get QuickBooks - Top-Rated Online Accounting Software For Businesses.

Jones provides an update on quarterly activities as well as his reflections on FASB activities and priorities including stakeholder outreach.

Limited Liability Companies Statement Of Financial Position Limited Liability Company Financial Position Financial

How To Calculate Depreciation Expense For Business

/depreciation---next-exit-road-524033056-0b86e2273334483db73ed6c98384339a.jpg)

Depreciation Definition

Leasehold Improvement Gaap Accounting Depreciation Write Off Efm

Gasb 87 Calculation And Accounting Example Part 2 Nakisa

Salvage Value Accounting Formula And Example Calculation Excel Template

Depreciation What Method To Choose And Is None An Option

The Basics Of Computer Software Depreciation Common Questions Answered

/double-declining-balance-depreciation-method-4197537-FINAL-9baf4fb736b74a1686dd768332f364b3.png)

Double Declining Balance Ddb Depreciation Method Definition With Formula

What Is Straight Line Depreciation Guide Formula Netsuite

The Facts And Figures Of Aircraft Depreciation

11 3 Explain And Apply Depreciation Methods To Allocate Capitalized Costs Business Libretexts

The Facts And Figures Of Aircraft Depreciation

The Facts And Figures Of Aircraft Depreciation

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Salvage Value Accounting Formula And Example Calculation Excel Template